Unpacking the Commodity Cycle: Patterns, Stages, and Investment Prospects

Avenues of the Commodity Super Cycle

We at Mia’s Best only give our financial opinions about a subject: This is in no way, shape or form financial advice. We are not registered financial advisors. You are responsible for doing your own due diligence before investing. Our dedicated team of writers and editors invests countless hours in meticulously analyzing before writing a financial opinion article. But, you are the sole responsible person for any financial gain or loss.

Commodities oil, gold, silver, coal (Image credit: Mia’s Best)

This piece will delve into the essence of the commodity cycle and its importance in the realm of investment. Knowledge of commodity cycles is pivotal for informed investment choices, particularly for adherents of a contrarian investment strategy. As a finance-oriented opinion portal, Mia’s Best strives to offer unique perspectives and viewpoints on a variety of investment avenues, including the commodity market.

- Mia's Best Summary

| Section | Key Points |

|---|---|

| Prelude | The article introduces the concept of the commodity cycle, a cyclic pattern of growth, peak, decrease, and bottoming out in commodity markets. Knowledge of these cycles is crucial for informed investment decisions. |

| Defining a Commodity Cycle | The article provides a definition of a commodity cycle, including the four primary stages: Growth, Peak, Decrease, and Bottoming Out. Each stage is associated with specific market conditions and trends. |

| Elements Impacting Commodity Cycles | This section explains that supply and demand dynamics and global economic development patterns significantly influence commodity cycles. Emerging markets and technological advancements are among the factors affecting commodity demand. |

| Detecting Signs of Commodity Cycles | This part discusses the use of technical indicators and fundamental analysis to identify trends and turning points in commodity cycles. These tools can help investors make informed decisions about when to enter or exit the market. |

| Investment Approaches for Commodity Cycles | The article suggests two investment strategies: investing in early stages of the cycle when growth potential is high, and investing in late stages where a more cautious approach is needed due to potential price peaks and supply restrictions. |

| Spreading Investments and Managing Risk | This section highlights the importance of diversification and risk management in commodity investments. The article suggests spreading investments across various commodities, sectors, and regions, and using techniques such as setting stop-loss orders to protect against market volatility. |

| Case Investigations: Historical Commodity Cycles | The article emphasizes the importance of studying past commodity cycles to gain insights into potential impacts on investments. Historical data can provide valuable lessons to incorporate into investment strategies. |

| Wrap-up | The final part reiterates the importance of understanding commodity cycles for contrarian investment opportunities. It advises investors to analyze supply and demand dynamics, economic growth trends, and use technical and fundamental analysis. Furthermore, adopting appropriate risk management strategies is critical to navigate volatility in commodity cycles. |

- Prelude

- Defining a Commodity Cycle

- Elements Impacting Commodity Cycles

- A. Dynamics of Supply and Demand

- B. Economic Development and Global Patterns

- Detecting Signs of Commodity Cycles

- A. Indicators of Technical Nature

- B. Analysis of Fundamental Nature

- Investment Approaches for Commodity Cycles

- A. Investing in Early Stages

- B. Investing in Late Stages

- Spreading Investments and Managing Risk

- Case Investigations: Historical Commodity Cycles

- Wrap-up

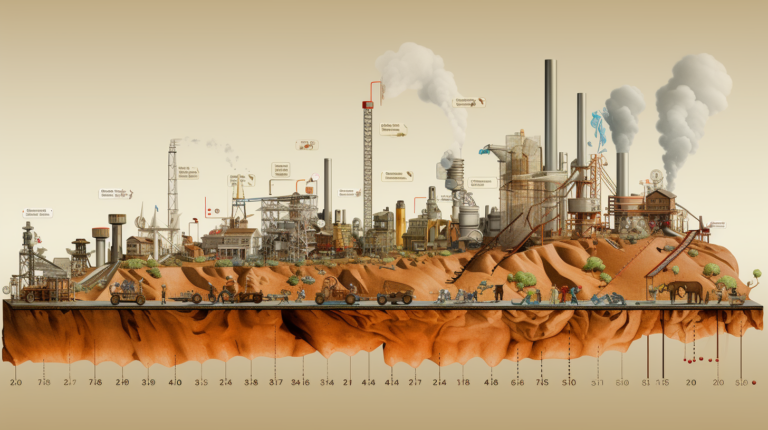

Commodity super cycle coming up (Image credit: Mia’s Best)

The commodity cycle denotes the cyclic pattern of commodity markets, wherein prices experience periods of growth, peak, decrease, and bottom out. Several factors shape these cycles, including the dynamics of supply and demand, economic expansion, and worldwide trends. Grasping these cycles empowers investors to pinpoint investment chances and potentially profit from shifts in commodity prices.

- RECOMMENDED VIDEO FOR YOU

Commodity super cycle coming up (Image credit: Mia’s Best)

A commodity cycle represents the recurrent sequence of price shifts in commodity markets. It encompasses four primary stages:

Growth: In this stage, commodity prices begin to climb due to surging demand and limited supply. Economic expansion, industrial output, and the demand from emerging markets usually propel this stage.

Peak: The peak stage signifies the zenith of the commodity cycle, where prices hit their maximum. Excessive speculation, overproduction, and possible supply restrictions mark this stage.

Decrease: During the decrease stage, commodity prices start to fall as demand dwindles or supply grows. This stage often correlates with economic downturns, diminished industrial activity, and shifts in market sentiment.

Bottoming Out: The bottoming out stage stands for the nadir of the commodity cycle, where prices plunge to their minimum. Oversupply, scant demand, and negative market sentiment define this stage.

A. Dynamics of Supply and Demand

Supply and demand alterations fundamentally mold commodity cycles. When demand surpasses supply, prices tend to ascend, initiating a growth stage. Conversely, when supply trumps demand, prices are likely to descend, leading to a decrease stage. Factors such as geopolitical occurrences, natural calamities, and governmental policies can affect supply and demand dynamics in commodity markets.

Commodities supply and demand graph (Image credit: Mia’s Best)

B. Economic Development and Global Patterns

Worldwide economic growth and progression have a significant effect on commodity demand. As economies burgeon, the need for commodities, such as energy, metals, and agricultural goods, rises. Emerging markets, notably, hold a pivotal role in driving commodity demand. Further, global patterns like technological advancements and the shift towards renewable energy sources can influence the demand for specific commodities.

To steer through commodity cycles effectively, investors must detect signs that hint at market direction. This task is achievable through indicators of technical nature and analysis of fundamental nature.

A. Indicators of Technical Nature

Technical indicators like moving averages, relative strength index (RSI), and chart patterns can assist investors in identifying trends and turning points in commodity cycles. These indicators shed light on market sentiment, momentum, and potential price reversals.

B. Analysis of Fundamental Nature

Fundamental analysis encompasses evaluating the driving factors behind commodity prices, such as supply and demand reports, inventory quantities, and macroeconomic data. By scrutinizing these fundamental elements, investors can attain a profound understanding of the commodity market and make educated investment decisions.

Investing in commodities cycles (Image credit: Mia’s Best)

Investing in commodity cycles demands thoughtful deliberation and the adoption of fitting investment strategies. Here are two prevalent methods:

A. Investing in Early Stages

In the early phases of a commodity cycle, substantial investment opportunities might arise. Identifying commodities that are in the growth phase and exhibit robust growth potential can yield potential returns. Nevertheless, early-stage investing also entails risks, given the volatile nature of market sentiment and supply-demand dynamics.

B. Investing in Late Stages

Investing during the later stages of a commodity cycle necessitates a more guarded approach. As prices reach their pinnacle and potential supply restrictions surface, it becomes imperative to safeguard investments and control risks. Strategies such as diversifying, profit realization, and hedging can help curb potential losses during commodity downturns.

Spreading risk of investments (Image credit: Mia’s Best)

When investing in commodities, diversification is vital to manage risk effectively. By scattering investments across diverse commodities, sectors, and geographical areas, investors can lower their exposure to specific risks. Additionally, risk management techniques, like setting stop-loss orders and routinely reviewing investment portfolios, can help shield against market volatility.

Historical commodity cycles (Image credit: Mia’s Best)

Scrutinizing past commodity cycles can offer precious insights into the potential impacts on investments. By analyzing historical data and studying the factors that affected previous cycles, investors can garner valuable lessons and integrate them into their investment strategies.

Deciphering the commodity cycle is vital for investors hunting for contrarian investment prospects. By dissecting supply and demand dynamics, economic growth trends, and using technical and fundamental analysis, investors can spot potential investment opportunities in commodity markets. However, it is critical to adopt suitable risk management strategies and spread investments to navigate the volatility and uncertainties inherent in commodity cycles.

Advertisement

FAQ

A commodity cycle refers to the repeating sequence of price changes in commodity markets. This cycle generally consists of four primary stages: Growth, Peak, Decrease, and Bottoming Out. These stages reflect the varying conditions of supply and demand, economic factors, and global trends affecting the commodities market.

The dynamics of supply and demand significantly shape commodity cycles. When demand surpasses supply, prices typically rise, indicating a growth stage. However, when supply exceeds demand, prices usually decrease, marking a contraction phase. Various factors, including geopolitical events, natural disasters, and government policies, can influence these dynamics.

Investors can detect signs of commodity cycles through technical indicators and fundamental analysis. Technical indicators like moving averages, the relative strength index (RSI), and chart patterns can help identify trends and potential turning points. Meanwhile, fundamental analysis, which involves examining core factors that influence commodity prices (such as supply-demand reports and macroeconomic data), can provide a deeper understanding of the market.

Investment approaches for commodity cycles include early-stage and late-stage investments. Early-stage investments focus on identifying commodities in the growth phase with strong potential for returns, while late-stage investments require a more cautious approach, utilizing strategies like diversification, profit realization, and hedging to minimize potential losses.

Investors can manage risks in commodity cycle investments through diversification and various risk management techniques. Diversification involves spreading investments across various commodities, sectors, and regions to reduce exposure to specific risks. Risk management techniques like setting stop-loss orders and regularly reviewing investment portfolios can also protect against market volatility.